Economy & Markets

8 min read

Japan's Path to Ruin: The Dangers of Takaichi's Fiscal Promises

Robin J Brooks | Substack

January 21, 2026•1 day ago

AI-Generated SummaryAuto-generated

Japan faces a potential debt crisis due to its enormous public debt and denial of the problem. Prime Minister Takaichi's platform to end fiscal austerity is viewed as irresponsible. The Bank of Japan's bond purchases weaken the Yen, while the Ministry of Finance attempts to strengthen it, creating market incoherence. Rising bond yields, particularly after the election announcement, signal fiscal crisis territory.

Japan will go to the polls on February 8. Prime Minister Takaichi is running on an end to “excessive” fiscal austerity. That’s highly irresponsible. I’ve been flagging for a long time that we’re in the early stages of a global debt crisis. Long-term government bond yields have risen sharply everywhere. Markets are losing patience with governments that are chronically unable or unwilling to bring public debt down. This is no time to pretend Japan’s humungous debt isn’t a problem. Denial isn’t a plan.

Yet denial is the only plan Japan seems to have. It’s almost certain that the Ministry of Finance (MoF) will intervene to lift the Yen. This can’t work because the Bank of Japan (BoJ) is still printing money to buy government bonds in substantial size. This puts depreciation pressure on the Yen. As long as that’s going on, MoF intervention will be ineffective. Even worse, it makes Japan look incoherent, with the BoJ weakening the Yen even as the MoF tries to strengthen it.

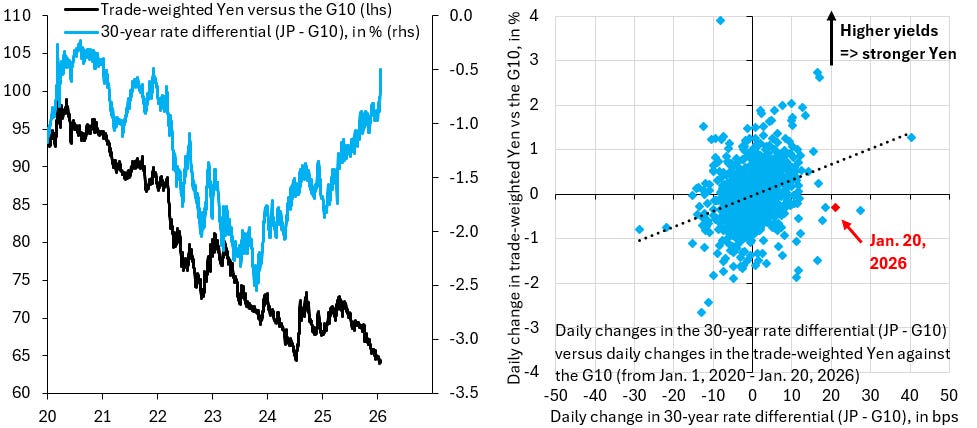

All this denial came to a head yesterday. News of the election spiked long-term bond yields. The blue line in the left chart above shows the 30-year rate differential of Japan vis-à-vis its G10 peers. The black line is the trade-weighted Yen versus the G10, where I use the same weights in the rate differential and the currency basket, i.e. the two are directly comparable. The right chart shows the same data, except that it looks at daily changes, which for the rate differential are shown in basis points on the horizontal axis and in percent on the vertical axis for the trade-weighted Yen.

The crazy thing about yesterday is that the Yen fell even though Japanese interest rates rose very sharply. Higher interest rates should attract inflows and - on average - strengthen the Yen. Indeed, that’s the case historically, as the upward-sloping line in the right chart attests. The fact that the Yen fell yesterday means we’re firmly in fiscal crisis territory in the same way the UK was in 2022. It’s worth noting that yesterday’s fall in the Yen would have been worse had markets not simultaneously been selling the Dollar due to the tensions over Greenland. The “true” extent of Yen weakness is therefore likely to have been far greater.

Japan’s denial on debt is firmly entrenched. If yields rise further, this could send Japan into a full-blown debt crisis, so the BoJ will be asked to cap yields before we get there. But this artificial yield cap just shifts the fiscal risk premium from the bond market to the currency. The Yen is the ultimate victim in Japan’s denial.

Rate this article

Login to rate this article

Comments

Please login to comment

No comments yet. Be the first to comment!