Economy & Markets

15 min read

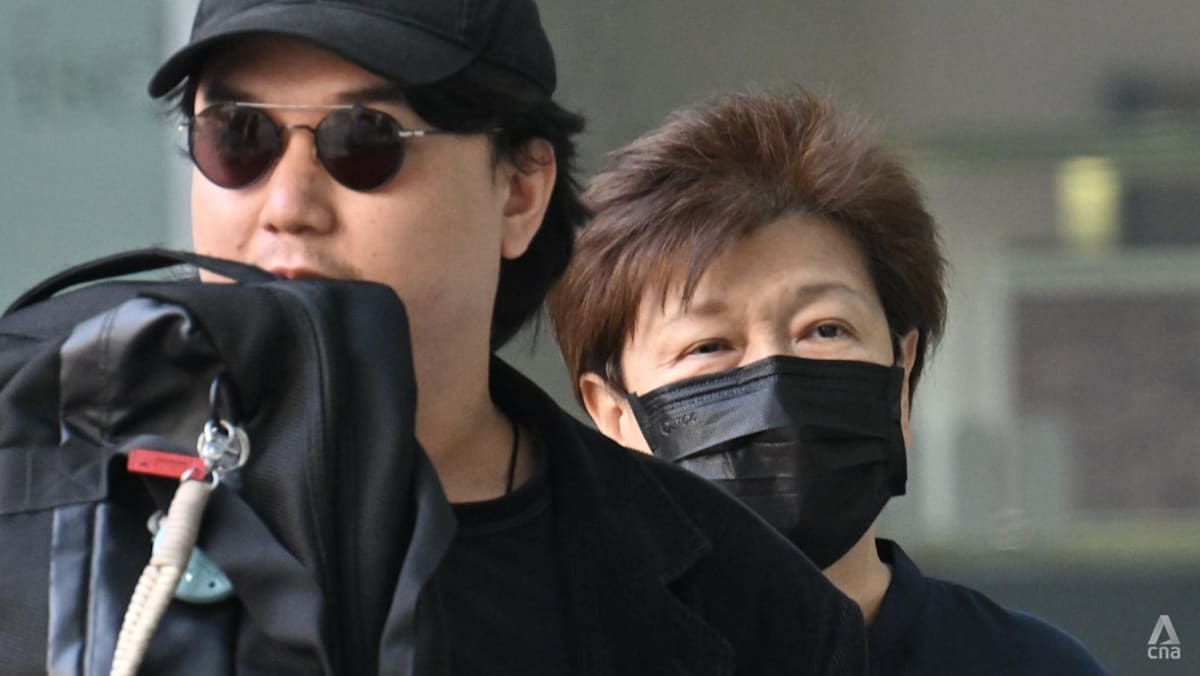

Hyflux Trial: Securities Expert Says Tuaspring Project Lacked Full Investor Picture

CNA

January 21, 2026•1 day ago

AI-Generated SummaryAuto-generated

A securities expert testified that Hyflux failed to provide investors with a complete picture of its Tuaspring project. The company allegedly omitted that revenue from its new power plant would subsidize low water prices. This led to the firm's collapse, impacting 34,000 investors and causing S$900 million in losses.

Hyflux had pitched the project to the market as its second and largest seawater desalination plant in Tuas, but allegedly omitted that it would fund the sale of water at a very low price to national water agency PUB with its new business of selling electricity from a power plant it would build.

The unsuccessful foray into Singapore's power market contributed to the company's collapse and affected about 34,000 investors who held perpetual securities and preference shares, and were owed a total of S$900 million (US$701 million), according to the prosecution.

PROSECUTION QUESTIONS MR GIN

Mr Gin was shown several documents including an announcement by Hyflux on Mar 7, 2011, where it stated that it had been named as the preferred bidder for the Tuaspring project.

In the announcement, Hyflux gave details about its new desalination plant and added that it would also be constructing a combined cycle gas turbine power plant to supply electricity to the desalination plant.

"Excess power will be sold to the grid," the announcement added.

Deputy Public Prosecutor Kevin Yong asked Mr Gin what his response to this announcement would be, if he were a common investor.

"Hyflux is basically going into building another desalination plant," responded Mr Gin. He added that the only difference was the combined power plant, which would supply electricity to the plant, with excess power sold to the grid.

Mr Gin said he would view the announcement positively, because Hyflux was expanding its business of water, which it was known for.

"And it's building a power plant to supply electricity," said Mr Gin. "I would read in between the lines and say it's trying to reduce cost of desalination."

Evidence has been given in the trial that Hyflux intended to use the revenue generated from the power plant to drive the overall profitability of the Tuaspring project.

Mr Gin said this information was not disclosed in the Mar 7, 2011 announcement.

Another witness had given evidence that the desalination plant drew its power from the grid, and that the power plant sold all its electricity to the grid.

Mr Gin said this was similarly not disclosed in the announcement.

"In the announcement ... (it) says it will construct a ... power plant to supply electricity to the desalination plant. Which is not the case. What's happened is, it's supplying electricity to the grid," said Mr Gin.

He said that if he were to discover this as an investor, he would view this information as "negative", because a common investor would know that Hyflux was in the water business, and not the electricity business.

Electricity generation would be a new business for Hyflux and would entail certain risks, said Mr Gin.

If investors knew that Hyflux intended for the power plant to subsidise the price of water it sold, they would take this information negatively, he added.

"It would raise a lot of red flags," he said.

Mr Gin said the disclosure in the announcement did not give the full picture of the facts.

Mr Yong then asked him why Hyflux could not leave the announcement as stating that excess power would be sold to the grid, and let the investor form their own views.

"When the term 'excess power' is used in the announcement, an investor would say it is not the main part of the business. Basically you're saying it's the excess," said Mr Gin.

He said excess was anywhere between 5 per cent and 10 per cent, but if it reached a certain threshold it would be significant.

He disagreed that a common investor would have been able to determine the omitted information on their own.

An expert for the defence had prepared a report stating that a common investor just needed to conduct "basic queries and do his homework" and he could determine the information, said Mr Yong.

The defence expert wrote in his report that it was "a matter of logic" that Hyflux would be going into a new business of electricity, based on the announcement.

Asked about this, Mr Gin said: "In the announcement, it's basically told that excess power will be sold to the grid. It's not going into a new business. If it's going into a new business, it's not excess power."

The trial continues. After Mr Gin finishes giving evidence the prosecution is expected to recall an investigation officer to admit some exhibits before closing its case.

If convicted of consenting to Hyflux's intentional failure to disclose the electricity sale information to the securities exchange, Olivia Lum could be jailed for up to seven years, fined up to S$250,000, or both.

For making an offer of securities to the public with omissions about the electricity sales, she could be jailed for up to two years, fined up to S$150,000, or both.

Rate this article

Login to rate this article

Comments

Please login to comment

No comments yet. Be the first to comment!