Economy & Markets

6 min read

Understanding the Global Bond Market Sell-Off: 5 Essential Charts

Robin J Brooks | Substack

January 21, 2026•1 day ago

AI-Generated SummaryAuto-generated

Global bond markets are experiencing a broad sell-off with rising long-term yields across major economies, excluding Switzerland. This trend coincides with a surge in precious metals like silver and gold, and a rally in safe-haven currencies such as the Swiss Franc. The US Dollar is facing depreciation pressure, while the Japanese Yen is predicted to continue debasing due to debt concerns.

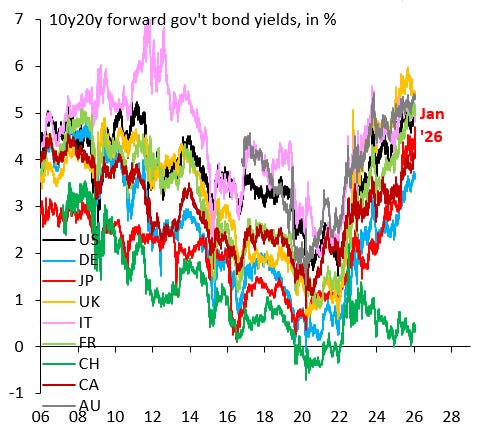

The rise in long-term yields is a global phenomenon. Japan is in focus, but the rise in long-term yields is really much broader. The chart below shows 10y20y forward yields across all key G10 economies. Switzerland (green line) - one of the world’s top safe havens - is the only outlier.

Precious metals are on fire. As the chart below shows, silver is now up 150 percent since Chair Powell’s dovish speech at Jackson Hole on August 22 and gold is up 43 percent. As on many previous occasions when the precious metals bubble goes into overdrive, this is spilling over into platinum and palladium.

Safe haven currencies rallied hard. The combination of debt sustainability fears and elevated geopolitical tensions drove safe haven currencies like the Swiss Franc and Swedish Krona sharply higher yesterday, as the chart below shows. The hunt for safe havens therefore isn’t just about precious metals. It’s about any and all assets that will protect principal.

The Dollar is under growing depreciation pressure. I’ve flagged the Dollar versus emerging markets (EM) as a key barometer for Dollar sentiment. As the blue line in the chart below shows, the Dollar has been falling against EM for many weeks. That weakness spilled over into the G10 Dollar yesterday as tensions rose over Greenland.

Don’t touch the Yen with a ten-foot pole. When currencies have been depreciating for some time, there’s a natural tendency to want to buy the dip. Don’t do that for the Yen. Japan is in total denial on its debt overhang. That will only change once Yen devaluation gets the government to change course. We’re nowhere near that. As crazy as it sounds, we’re in my opinion only in the early stages of Yen debasement. The decoupling between rate differentials and the Yen - shown in the chart below - has a lot further to go.

Rate this article

Login to rate this article

Comments

Please login to comment

No comments yet. Be the first to comment!