Economy & Markets

14 min read

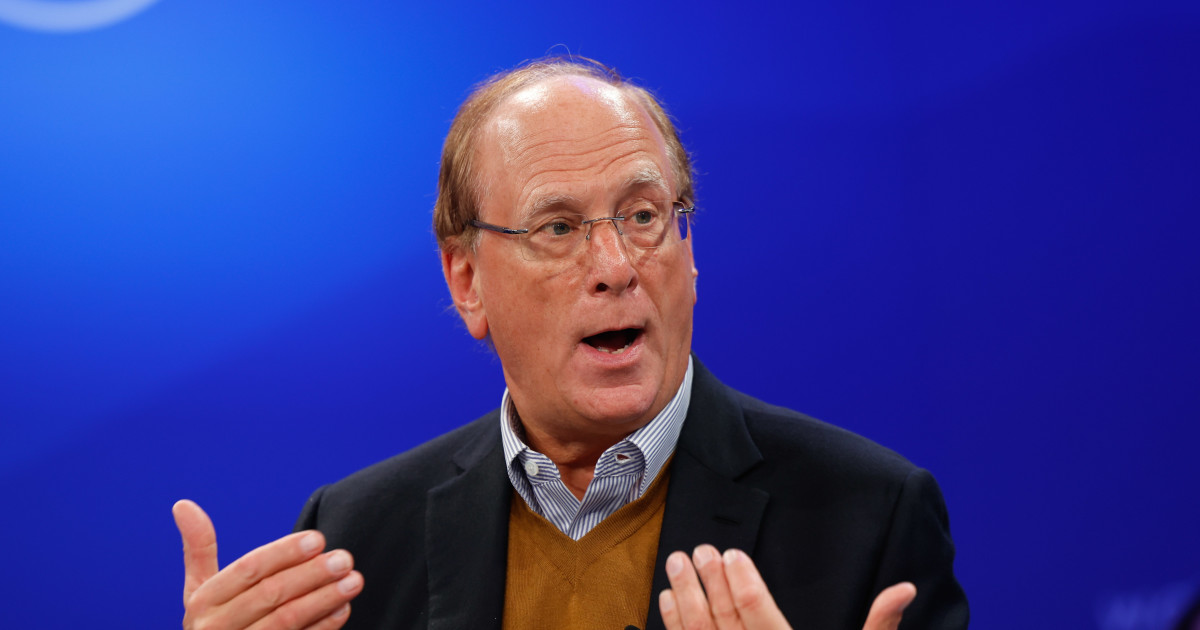

BlackRock CEO Larry Fink's Blunt Warning on Soaring US National Debt

thestreet.com

January 18, 2026•4 days ago

AI-Generated SummaryAuto-generated

BlackRock CEO Larry Fink warns that markets are underestimating the growing U.S. national debt, now over $38 trillion. He believes fiscal policy, not monetary policy, will soon become a major concern. Rising interest costs on the debt could crowd out spending and lead to higher borrowing costs, impacting stock valuations and housing affordability. Despite this, Fink remains optimistic about the U.S. economy's current growth prospects.

BlackRock (BLK) CEO Larry Fink feels the market’s attention could soon shift toward the ballooning U.S. national debt.

With U.S. debt now soaring over $38 trillion, Fink believes that markets are underestimating the moment when fiscal policy, not monetary policy, becomes a major problem.

Clearly, over the past year in particular, I’ve seen a lot of headlines covering the U.S. national debt, and for the most part, they’ve landed with a dull thud.

Nevertheless, these catastrophic headlines continue to be buried under the excitement over AI, strong quarterly reports, and election-year politics.

However, since the debt moved past $38 trillion last October, the conversation has started to feel a lot more uneasy.

That tension is showing up in Reddit forums like r/Economics, which has about 827,000 members. One user, Bozihthecalm, put it especially succinctly.

That’s the backdrop for Fink’s warning in a recent CNBC interview, as he lays out why the debt conversation is approaching a turning point.

Why ballooning national debt matters economically

Picture the U.S. as a sort of house with a massive mortgage-sized balance on a credit card. You can continue rolling your debt based on trust, as long as your interest bill is “manageable.”

Over time, as the balance rises, even the smallest rate changes could result in substantial incremental interest expense.

The downer is that the “extra” is basically used to service the past.

For perspective, the interest expense on the public debt is already surging.

More Experts

Longtime fund manager sends blunt message on P/E ratios

Jim Cramer issues blunt 5-word verdict on Nvidia stock

What the White House decision really means for Nvidia

Michael Burry shares bold predictions for OpenAI, Palantir

Interest outlays are up a substantial 15% to $355 billion in Q1 fiscal 2026 (Oct.-Dec. 2025), Reuters reports, as the average interest rate hovers at 3.32% (the highest it has been since 2009).

Hence, it’s nothing short of a ticking time bomb, leading to a myriad of problems.

Interest costs rise quietly. Growing debt pushes interest costs higher, effectively crowding out other spending and forcing tough fiscal choices.

Markets move rapidly when confidence shifts. Strong Treasury demand can effectively mask underlying problems for years, but once confidence wobbles, borrowing costs will adjust quickly.

Distractions delay focus. AI optimism, earnings season, and Fed debates continue to keep attention elsewhere.

In addition, bigger deficits ripple across multiple markets.

Higher borrowing costs push interest rates higher, which weighs down stock valuations, with growth stocks taking the bigger hit.

Mortgage rates typically follow Treasury yields, which end up hurting housing affordability (already depressed) and demand. In bond markets, increased Treasury issuance results in higher yields, lower prices, and greater rate volatility.

Larry Fink says national debt matters more than markets think

Fink told CNBC’s “Squawk on the Street” that markets continue to obsess over the Federal Reserve, while hardly discussing fiscal discipline (as the national debt creeps higher).

Hard numbers behind U.S. debt:

Total U.S. debt outstanding: $38.4 trillion as of Jan. 14, 2026

Change (Sept. 3, 2025, to Jan. 14, 2026): Roughly $996 billion added

Fink says those unsettling numbers rose last year, and the pattern is unlikely to change this year.

The primary concern, though, is confidence.

He argues that the U.S. Treasury market is the global benchmark, and that if international investors start questioning America’s fiscal trajectory, it could lead to a significant drop in foreign ownership of Treasuries (that’s when the real pressure starts).

In that grim situation, inflation is likely to remain relatively contained, but interest rates are likely to rise because deficits are high and financing costs are more expensive.

However, Fink also points to a potential offset.

Larry Fink sees a stronger U.S. economy for now

Fink is still a big believer in the U.S. economy and argues things are looking mostly constructive at this point. He feels the bull story is still intact, but its durability matters a lot more.

Particularly for risk assets, he argues that investing looks a lot better today than it did a year ago.

A big part of that is the growing clarity around the geopolitical situation, and though political and global “noise” will weigh down specific sectors, the broader economic foundation has improved.

Growth is at the heart of that outlook.

Fink believes that the U.S. is entering a brand new growth phase, even suggesting the economy could have grown at nearly a strong 5% pace in Q4.

Rate this article

Login to rate this article

Comments

Please login to comment

No comments yet. Be the first to comment!